What is a Vesting Smart Contract

In the blockchain world, vesting smart contracts are a crucial tool for managing tokens and ensuring secure transactions.

They maintain transparency, security, and compliance across various industries.

This article will explore the intricacies of vesting mechanisms, discussing their benefits, key components, and real-world applications.

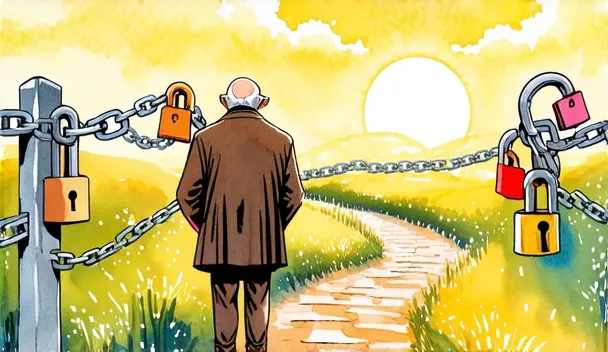

By understanding how vesting smart contracts work, you'll be able to harness their potential for efficient token management and unlock blockchain technology's full potential.

Unlocking the Potential of Blockchain: Understanding Vesting Mechanisms

Deciphering Vesting Periods and Unlock Schedules

A vesting smart contract's effectiveness relies heavily on its vesting periods and unlock schedules, which dictate when funds or assets are released to the recipient.

These mechanisms ensure that releases align with project goals and milestones, fostering trust and accountability within the community.

Vesting Mechanisms: Time-Locked vs. Event-Triggered Releases

Smart contracts often involve two types of release schedules: time-locked and event-triggered releases.

Time-locked releases unlock assets after a predetermined period, such as releasing 25% of shares every year over four years.

In contrast, event-triggered releases rely on specific events or milestones being met before assets can be unlocked, including reaching revenue targets, completing project milestones, or achieving regulatory approval.

Enhancing Security and Transparency with Vesting Mechanisms

By implementing time-locked smart contracts, vesting ensures that funds are released only when predetermined conditions are met, preventing malicious actors from exploiting vulnerabilities.

This also increases transparency as all parties have visibility into the vesting schedule and conditions, promoting accountability and trust among stakeholders.

Advantages of Implementing Vesting Smart Contracts for Efficient Token Management

Boosting Security with Time-Locked Tokens and Transparent Release Schedules

Vesting smart contracts offer a robust security mechanism by utilizing time-locked tokens, allowing developers to restrict access to sensitive information or assets until a predetermined timeframe has passed.

This feature safeguards digital assets from unauthorized access or manipulation, mitigating risks associated with premature token distribution, insider threats, and other malicious activities.

Additionally, vesting smart contracts promote transparency and trust among investors by creating transparent release schedules.

This allows founders to demonstrate their commitment to the project's long-term success rather than immediate gains, building confidence among investors who are more likely to participate in projects with clear and predictable token distribution strategies.

Optimizing Token Liquidity Management for Market Stability

Vesting smart contracts enable efficient token management, optimizing liquidity control and promoting market stability.

By implementing a vesting schedule, projects can prevent massive token dumps that often lead to price volatility, maintaining a balance between supply and demand and reducing the risk of sudden price fluctuations.

Key Components and Features of Vesting Smart Contracts: A Deep Dive

Token Release Mechanisms and Security Features

A token release mechanism is a critical component of vesting smart contracts, determining how and when tokens are released to recipients such as employees or investors.

There are three primary types of mechanisms: cliff-based, linear, and milestone-based releases. Cliff-based releases involve releasing a percentage of tokens at the end of a predetermined period, while linear releases involve a steady stream of tokens over time.

Milestone-based releases tie token releases to specific events or achievements.

Enhancing Security and Flexibility

Vesting smart contracts are designed with security features such as multi-signature wallets, which require multiple signatures or approvals before funds can be transferred or vested.

This adds an extra layer of security against unauthorized transactions. Additionally, vesting schedules can be paused or cancelled in case of unforeseen events, allowing for adaptability to changing circumstances.

Customizable Solutions

Vesting smart contracts offer a high degree of flexibility, enabling developers to tailor solutions to specific use cases by defining unique parameters and rules governing the vesting process.

This customization allows companies to create vesting contracts that meet their unique needs, such as requiring employees to remain with the organization for a certain period before unlocking vested tokens.

Exploring Types of Vesting Schedules: A Comprehensive Analysis

A time-based vesting schedule is a popular type where tokens or assets are released based on a predetermined timeframe, offering predictability and structure.

This means that the recipient can only access their vested assets after a specific period, such as quarterly, annually, or monthly.

For instance, an employee may be granted 1000 tokens with a 2-year cliff period and a 3-year linear vesting schedule.

Performance-Based Vesting Schedules: A Comparative Analysis

Performance-based vesting schedules tie the release of tokens to specific performance metrics, incentivizing teams to work towards common goals.

This type of schedule can be particularly effective in aligning everyone's interests and focusing on driving success.

Vesting Schedule Variations and Hybrid Approaches

In some cases, a single vesting schedule may not meet all stakeholders' needs.

Companies can combine different schedules to create a tailored solution, balancing fairness, flexibility, and employee retention.

This might involve using cliff-based vesting for early employees, linear vesting for later hires, or employing tiered vesting with multiple cliffs or milestones.

Token Release Mechanisms Demystified: How Vesting Smart Contracts Evolve Over Time

Linear Token Release Schedules and Customization Options

A linear token release schedule is a common mechanism used in vesting smart contracts, releasing tokens at a steady, predetermined rate over time.

For instance, if a founder is allocated 1,000 tokens with a 12-month vesting period, they would receive 83.33 tokens per month (1,000 / 12).

This approach simulates a steady income stream and can be further customized by introducing cliffs, where no tokens are released until a certain time period has elapsed.

Unlock Dates, Milestones, and Time-Based Distribution Mechanisms

Vesting smart contracts often rely on specific triggers to release tokens, ensuring that the recipients adhere to predetermined conditions. These triggers include unlock dates, milestones, and time-based distribution mechanisms.

Unlock dates refer to a fixed point in time when a certain amount of tokens is released to the recipient, while milestones are specific events or achievements that must be met before token release can occur.

Time-based distribution mechanisms allow for a more controlled and gradual distribution of assets over a predetermined period, helping prevent token dumping and ensuring team members or investors remain committed to the project's long-term success.

Prioritizing Security, Transparency, and Compliance in Vesting Smart Contract Design

Implementing Secure Multi-Party Governance and Transparency

A well-designed vesting smart contract prioritizes security, transparency, and compliance by incorporating secure multi-party governance. This involves creating a system where multiple parties have control over the vesting process, ensuring that no single entity has absolute authority.

By leveraging blockchain technology, these contracts are recorded on a publicly accessible ledger, making all transactions and interactions visible to authorized parties.

This inherent transparency fosters trust among stakeholders and allows for real-time monitoring of contract execution.

Ensuring Compliance with Regulatory Requirements

Vesting smart contracts can navigate complex regulatory landscapes by incorporating specific clauses into the contract code. This self-regulatory mechanism enables adaptability to changing regulations while maintaining transparency and security.

For instance, identity verification (KYC) or anti-money laundering (AML) checks can be integrated into the contract code, ensuring adherence to relevant laws and regulations.

By embedding compliance protocols within the smart contract, developers can ensure that their vesting solutions remain compliant with regulatory requirements.

Real-World Applications of Vesting Smart Contracts in Blockchain Ecosystems

Vesting Schedules for Startups and Employee Incentives

In the startup world, vesting schedules can be a game-changer. By implementing well-designed vesting schedules, founders and investors can incentivize team members to work towards long-term goals rather than short-term gains.

This approach promotes retention and commitment, driving growth and success.

For example, cliff vesting schedules release 25% of the vested amount after one year, with the remaining 75% distributed linearly over three years.

Unlocking Tokens Based on Performance Milestones

Vesting smart contracts can be applied to various real-world scenarios, enabling the unlocking of tokens based on performance milestones.

Startups and companies use vesting contracts to incentivize employees by offering tokens that are unlocked upon achieving specific goals or completing projects within a set timeframe.

This approach ensures team members remain committed and focused on delivering results, as their rewards are directly tied to the company's success.

Conclusion

This guide has explored the key components, features, and applications of vesting smart contracts, including various types of vesting schedules and token release mechanisms.

By now, you should have a solid understanding of how vesting smart contracts can enhance security, transparency, and compliance in token management.

As blockchain technology continues to grow, vesting smart contracts will play an increasingly important role in shaping the future of cryptocurrency and tokenized assets.

To dive deeper into this topic, explore real-world applications in blockchain ecosystems or experiment with designing your own vesting smart contract.