Swapping Tokens on Solana

We’ll explore the essentials of token swapping, including the mechanics behind it and the pivotal role of liquidity pools, to empower you in diversifying your crypto portfolio.

Understanding Token Swapping in DeFi

Token swapping is a basic yet crucial activity within the Decentralized Finance (DeFi) space, facilitating several key functions:

Portfolio Diversification

Token swapping allows investors to manage risk by spreading their exposure across multiple assets, thereby mitigating the impact of adverse market movements on their overall portfolio. It opens up opportunities to explore new markets, including emerging or niche projects that offer potential for high returns. This process provides investors with the flexibility to quickly adapt their investment strategies without traditional intermediaries, making adjustments both straightforward and cost-effective.

Access to Services

Swapping is key to engaging with the full spectrum of DeFi services, from borrowing and lending platforms to yield farming and liquidity mining. It enables users to acquire specific utility tokens required for transaction fees, governance, or accessing specialized functionalities on various platforms. Moreover, token swapping facilitates interactions across different blockchains, enhancing interoperability and extending the reach of users' investments into new ecosystems.

Strategy Optimization

Through token swapping, investors can swiftly respond to market trends or news, realigning their portfolio with the current market outlook to optimize returns. This activity allows for the pursuit of higher yields by reallocating assets into different tokens or pools, maximizing investment efficiency. Swapping also offers a means to strategically move assets to minimize transaction costs, leveraging times of lower gas fees, or selecting tokens with inherently lower transaction costs, thereby enhancing cost efficiency in portfolio management.

How To Swap Tokens On Solana

Swapping tokens on Solana is streamlined and efficient, thanks to innovative platforms like the Jupiter Aggregator. Here’s a closer look at how to navigate token swapping on this high-speed blockchain:

Using Jupiter Aggregator for Optimal Trades

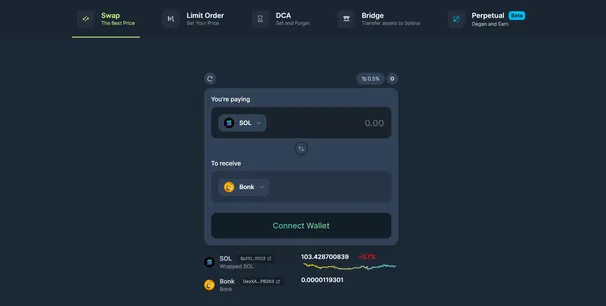

Jupiter Aggregator stands out on Solana for its ability to provide users with the most favorable trade rates. By pooling liquidity from a multitude of sources, Jupiter ensures that trades are executed efficiently, with the advantages of minimal slippage and low gas fees, characteristics that are synonymous with Solana’s blockchain. Here's how to use Jupiter for swapping tokens:

Start by visiting Jupiter’s web application, a user-friendly platform engineered to streamline your trading experience. This web app stands out for its intuitive design, allowing users to quickly navigate through its features and functionalities. It aggregates data from a vast network of liquidity pools and on-chain order books, presenting you with the most competitive prices for a wide array of tokens. This ensures that you are not just making an informed decision but also capitalizing on the best possible trading opportunities available across the Solana ecosystem.

Jupiter’s platform distinguishes itself with a state-of-the-art routing algorithm. This sophisticated system is more than just a pathfinder; it's an intelligent algorithm that analyzes the DeFi landscape in real-time to chart the most efficient course for your trade. By considering factors such as liquidity depth, transaction fees, and potential slippage, Jupiter’s routing algorithm meticulously selects the optimal pathways through various liquidity providers. This intelligent routing ensures that your transactions are not only executed swiftly but are also optimized for price, significantly enhancing the value you get from each trade.

Completing a swap on Jupiter is a seamless process that culminates in the secure execution of your trade at the most favorable rate available. After you’ve made your token selection and reviewed the transaction details, including any associated fees and the expected outcome, a simple confirmation triggers the final step, securely communicating with the Solana blockchain and executing your swap with precision and reliability. This direct interaction with the blockchain ensures that your trade is not only completed efficiently but also aligns with the highest security standards, providing peace of mind alongside optimal trading results..

Alternatives for Token Swaps on Solana

For those who prefer a more hands-on approach or have a specific liquidity provider in mind, Solana also supports direct swaps through platforms like Orca and Raydium. These platforms offer user-friendly interfaces that facilitate direct swaps, giving you control over the specific liquidity pool you wish to engage with. Other platforms, such as Openbook and Phoenix DEX offer Central Limit Order Book (CLOB) trading products for more sophisticated traders.

The Importance of Liquidity Pools

Liquidity pools.com/learn/crypto-liquidity-pool)* serve as the backbone of the decentralized finance (DeFi) ecosystem, facilitating token swaps and ensuring the seamless operation of exchanges. Here’s a deeper look at their significance:

Foundation of Token Swaps

Liquidity pools act as reserves of tokens, allowing users to exchange one cryptocurrency for another without the need for a traditional buyer-seller match. This model is fundamental to decentralized exchanges (DEXs) and is what enables the instant swap capabilities that users enjoy.

By eliminating the need for order books, liquidity pools democratize access to trading, making it possible for anyone to contribute to the liquidity of a token and benefit from the trading fees generated.

Role of Liquidity Providers (LPs)

Liquidity providers are individuals or entities that deposit their tokens into these pools. In return, they receive a portion of the transaction fees or other rewards generated by the pool’s activity, such as yield farming incentives.

While providing liquidity can be lucrative, it also comes with risks such as impermanent loss, especially in volatile market conditions. Understanding these risks is crucial for anyone considering becoming an LP.

Impact on the DeFi Ecosystem

Liquidity pools are essential for maintaining the efficiency and stability of the DeFi market. High liquidity in a pool means lower slippage for traders, making it more attractive for larger swaps.

The concept of liquidity pools has spurred innovation within DeFi, leading to the development of new financial instruments, yield strategies, and decentralized applications (dApps) that leverage the pooled liquidity model for various services.

By providing a platform where liquidity can be sourced from a wide array of participants, liquidity pools enhance the inclusivity of the DeFi space, allowing smaller investors to participate alongside larger entities.

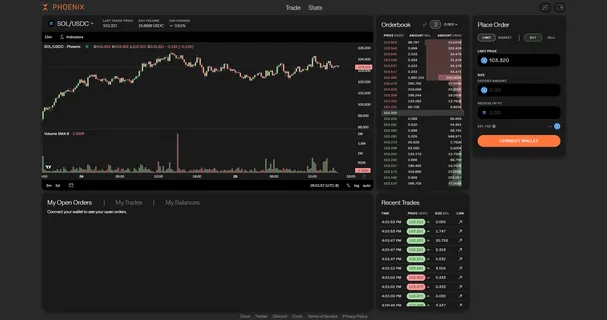

The Importance of Central Limit Order Books (CLOBs)

Central Limit Order Books (CLOBs) play a pivotal role in the decentralized finance (DeFi) landscape on Solana, offering traders a traditional yet powerful mechanism for swapping tokens. Here’s an in-depth examination of their importance:

Enabling Precise Market Operations

CLOBs allow traders to place bids (buy orders) and asks (sell orders) at specific prices, granting them control over the price at which they're willing to trade. This precision is particularly beneficial for traders looking to execute large orders or enter/exit positions at targeted price levels. Unlike liquidity pool-based swaps, which rely on an algorithmic price determined by the pool's current state, CLOBs facilitate real-time price discovery through the dynamic interaction of buy and sell orders. This can lead to more efficient markets and tighter spreads.

Platforms on Solana Utilizing CLOBs

Two notable examples of platforms on Solana that leverage on-chain order books are Openbook (formerly known as Serum) and Phoenix DEX. These platforms offer decentralized exchanges with the speed and scalability benefits of Solana’s blockchain, enabling high-frequency trading and institutional-grade order matching.

Interestingly, liquidity pools and CLOBs on Solana can interact programmatically. This hybrid approach combines the best of both worlds—automatic market making from liquidity pools with the strategic trading opportunities of CLOBs. Such interactions can enhance liquidity and offer more sophisticated trading strategies, benefiting both liquidity providers and traders.

Advantages of CLOBs in DeFi

CLOBs provide traders with the flexibility to set specific prices for their trades, enabling more strategic decision-making. This is especially useful in volatile markets or for assets with less liquidity.

They also offer visibility into the market's depth, displaying the range of bid and ask orders at different price levels. This transparency helps traders assess market sentiment and liquidity before making trades.

By allowing direct interaction between traders' orders, CLOBs complement the DeFi ecosystem on Solana, offering an alternative to the automated mechanisms of liquidity pools. This diversity in trading mechanisms enriches the ecosystem, catering to a wider range of trading preferences and strategies.

Choosing Tokens

When deciding which tokens to swap, it's important to carefully evaluate potential options based on several critical factors. Here’s a practical approach to guide beginners through the process:

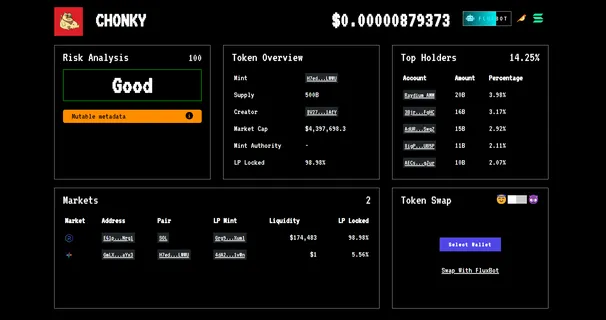

Evaluating the Project and Token Fundamentals

Research the project behind the token. Consider whether it addresses a significant problem and has a clear roadmap. Projects with a solid foundation are more likely to be sustainable and experience growth.

The presence of an active development team suggests a project's commitment to progress. Review activity on GitHub or similar platforms for recent updates and developer engagement.

The token's role within its ecosystem is crucial. Tokens that serve a clear purpose, such as facilitating transactions, enabling governance, or granting access to services, often have more stable demand.

Analyzing Market Performance and Growth Potential

Reviewing a token's past performance, market capitalization and trading volume can provide context for its volatility and market behavior. Use resources like CoinGecko or CoinMarketCap for historical data analysis.

Assessing community and market sentiment towards the token can offer insights into its potential for success. Social media, forums, and news articles are good sources for this analysis.

Evaluate the potential for future growth. Look into any planned developments, partnerships, or expansions that could positively influence the token's value.

Navigating and Mitigating Risks

Token swapping in the decentralized finance (DeFi) ecosystem offers access to diversification and potential gains but also exposes participants to certain risks. Recognizing and managing these risks is essential for informed decision-making.

Understanding the Risks

The cryptocurrency market's inherent volatility and the possibility of liquidity shortages present significant risks to token swappers. Here, we delve into these risks to better prepare for them.

Cryptocurrency prices can change dramatically in short periods, affecting the value of tokens post-swap.

Tokens, especially from newer or less established projects, may suffer from limited liquidity, complicating swap executions without significant price impacts.

This occurs when the executed price of a swap differs from the expected price, especially in volatile or illiquid markets, potentially resulting in less favorable outcomes.

Mitigating Risks

Armed with an understanding of the potential pitfalls, we can now look at strategies to lessen their effect on our investments.

By investing across a broad range of tokens and asset classes, the impact of volatility can be diminished. This approach forms the cornerstone of effective risk management.

Investigating the liquidity of tokens before swapping can prevent significant slippage, ensuring smoother transactions.

Platforms offering the ability to set limit orders or specify slippage tolerance can be invaluable in managing the risk of unexpected price movements.

The Importance of Continuous Education

Staying informed through continuous education is pivotal in adapting to the ever-evolving landscape of cryptocurrency trading.

Regularly monitoring market trends and regulatory developments can offer valuable insights into potential market shifts.

A thorough understanding of a project's roadmap, team, and technological innovations can indicate its long-term potential.

Employing risk management strategies like setting stop-loss orders or taking profits at predetermined levels can safeguard against substantial losses.

Conclusion

Token swapping on Solana, particularly through platforms like Jupiter Aggregator, represents a pivotal entry point into the diverse and dynamic world of decentralized finance. This guide has walked you through the essentials—from the mechanics of token swaps and the critical role of liquidity pools to strategic token selection and risk management. However, the journey into DeFi does not end here.

As you become more familiar with token swapping, we encourage you to continue exploring, learning, and participating in the Solana DeFi ecosystem. The landscape is continually evolving, with new technologies, projects, and opportunities emerging regularly. Staying informed and adaptable will be key to navigating this space successfully.

Remember, the path to becoming proficient in DeFi is a process of ongoing education and hands-on experience. Engage with the community, experiment with small transactions to understand the nuances of different platforms, and always prioritize the security of your investments. By doing so, you're not just participating in DeFi; you're contributing to a financial revolution that promises greater inclusivity, transparency, and efficiency.