Comparing Staking on Different Blockchains

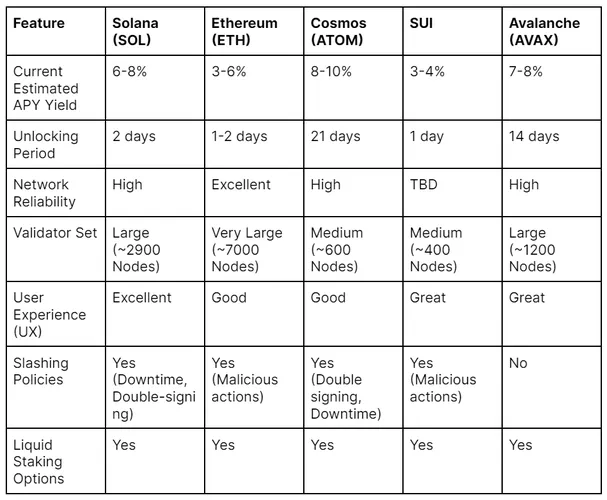

Staking has emerged as a cornerstone for modern blockchain networks where fast speeds and low energy costs are important. Unlike the energy-intensive process of mining required by Proof of Work (PoW) systems, Proof of Stake (PoS) networks offer a greener, more accessible way to participate in blockchain security and consensus. This guide delves into the world of staking across several leading PoS networks—Solana, Ethereum, Cosmos, SUI, and Avalanche—unpacking the essentials for beginners and those early in their crypto journey. Through a comprehensive comparison, we explore the intricacies of stake pools, delegation strategies, and cutting-edge features like directed stake, native algorithmic stake, and bonding.

What is Staking?

Staking in a Proof of Stake (PoS) network involves participants locking up a certain amount of the network's cryptocurrency, which is then used to help validate transactions and create new blocks. Unlike the Proof of Work (PoW) model, where the probability of creating a new block and receiving rewards is determined by computational power, PoS chooses validators based on the number of tokens they are willing to "stake" as collateral. This process not only secures the network and processes transactions but also incentivizes token holders by rewarding them with additional tokens, similar to earning interest on an investment.

How Staking Works

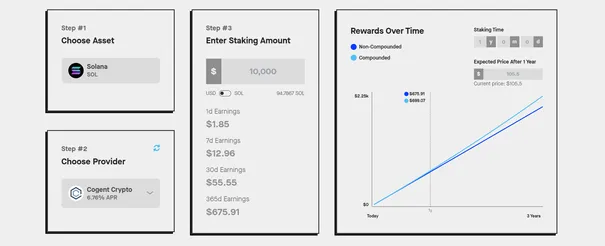

Solana Staking

In the Solana ecosystem, participants can engage in staking to earn rewards and contribute to the network's security. With an initial annual inflation rate set at 8% and designed to decrease by 15% each year until stabilizing at a long-term rate of 1.5%, Solana offers a compelling dynamic reward structure for stakers. Validators, crucial for processing transactions and securing the blockchain, are empowered by the Proof-of-Stake (PoS) consensus mechanism, which weights their influence based on the SOL staked with them. Staking on Solana is executed by delegating SOL tokens to validators without relinquishing control or ownership, bolstering network security and its resilience against attacks. The design ensures that as SOL is more distributed across validators, the network's robustness and defense against potential threats are significantly enhanced.

Staking Solana tokens offers the opportunity to earn yield based on the inflation rate, total SOL staked across the network, and the performance of chosen validators. This reward mechanism incentivizes token holders to participate actively in network security, with returns/yield affected by the network’s overall staking volume and the efficacy of individual validators. Careful selection of validators by token holders increases the network's decentralization and security, fostering a healthier ecosystem.

While Solana currently does not implement an automatic slashing mechanism, the community has laid the groundwork for potential future incorporation to safeguard against malicious validators. This approach underscores Solana’s commitment to network integrity without immediately exposing stakers to slashing risks. Understanding the potential for future slashing is crucial for validators and delegators alike, as it emphasizes the importance of maintaining high standards of operation and contributing positively to the network’s security.

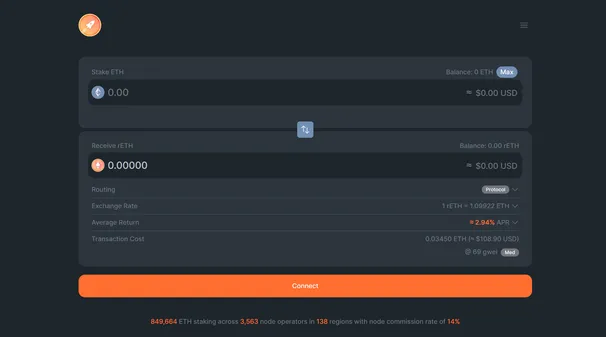

Ethereum* Staking

In the evolving landscape of Ethereum, now more than ever, staking stands as a cornerstone for network security and consensus following its monumental transition to Proof of Stake (PoS). With a staggering total of over 29 million ETH already staked by nearly a million validators, Ethereum staking offers a current APR of 3.5%, creating a lucrative opportunity for participants. Anyone can become a validator by starting a node with a 32 ETH deposit, which empowers contributors to partake in data storage, transaction processing, and the expansion of the blockchain, while earning new ETH. For people interested in staking ETH without starting their own full node, liquid staking pools like Rocket Pool offer the option to stake any amount of ETH. This process not only incentivizes the maintenance of Ethereum's security but also democratizes the earnings distribution through staking rewards.

The incentive model for Ethereum staking is very simiilar to Solana's -- it is meticulously designed to reward validators for their indispensable role in steering the network towards consensus. By engaging in activities that bolster network security—such as batching transactions into blocks and validating the work of peers—validators earn rewards in ETH, enhancing their direct financial gains. This system fortifies Ethereum's resilience against potential attacks, underpinning a more secure ecosystem for all users. Moreover, Ethereum's PoS model pivots towards environmental sustainability, significantly reducing the energy footprint compared to the previously used proof-of-work model.

Within Ethereum's PoS framework, slashing mechanisms act as a critical safeguard against validator malfeasance, including behaviors like double-signing or failure to maintain network integrity. These measures are integral to preserving Ethereum's security, imposing penalties on validators who deviate from protocol expectations. However, the implementation of slashing is balanced with considerations for fairness, ensuring that penalties are judiciously administered to maintain a high level of trust and active participation among validators in the staking ecosystem.

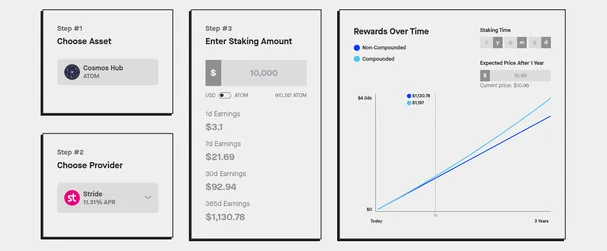

Cosmos Staking

In the ever-evolving blockchain ecosystem, Cosmos (ATOM) distinguishes itself with its advanced interoperability and scalability features, facilitated by the Inter-Blockchain Communication (IBC) protocol. A cornerstone of this system is staking, which empowers ATOM holders to contribute to the network's security and governance, while earning rewards. Similar to Solana, Cosmos operates on a Delegated Proof of Stake (dPoS) mechanism, enabling validators to stake ATOM tokens to secure the network. ATOM holders can delegate their tokens to these validators, indirectly participating in network security and governance. This inclusive approach not only bolsters network security but also encourages widespread participation by allowing any ATOM holder to contribute and reap rewards.

Yield for Cosmos staking is derived from block rewards — fueled by the network's inflation mechanism — and transaction fees accumulated in blocks. The Annual Percentage Yield (APY) for staking ATOM can be compelling, enticing ATOM holders to engage in the network's security and governance processes. Rewards are proportionately distributed among validators and their delegators, with validators deducting a commission for their services. This system incentivizes both security contributions and active participation in the Cosmos ecosystem's governance.

Cosmos implements slashing conditions to ensure validators' alignment with the network's best interests. Validators face slashing for serious infractions such as double signing and experiencing prolonged downtime. These slashing penalties are deliberately stringent to deter any malicious actions, thereby safeguarding the network's integrity and trustworthiness. It's a critical measure to maintain the security and operational efficiency of the Cosmos ecosystem.

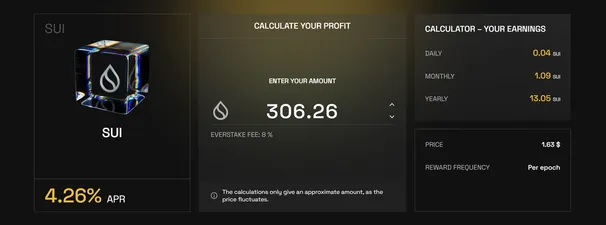

SUI Staking

SUI, aiming to redefine scalability and user experience, introduces a sophisticated staking mechanism central to its Delegated Proof-of-Stake (DPoS) consensus. This approach emphasizes network security and participatory governance, making staking both accessible and rewarding. Validators, pivotal to the SUI network, ensure its integrity by processing transactions and participating in consensus. SUI's innovative staking model encourages wide participation, allowing token holders to delegate their tokens to validators, thus contributing to the network's evolution. The inclusion of features such as directed stake and bonding showcases SUI's commitment to fostering a dynamic ecosystem where users and validators collaborate closely.

SUI's staking incentives are designed to reward participants actively contributing to the network's security and efficiency. Validators and delegators are compensated through a combination of transaction fees and network-specific incentives. The early phases of the network feature staking rewards composed of stake subsidies and gas fees, ensuring validators are adequately rewarded for their service. As SUI evolves, the incentive model is expected to adapt, maintaining competitiveness and reflecting the network's maturation.

SUI's slashing mechanism is under development, aiming to align with best practices to maintain network integrity and discourage malicious behaviors. Potential penalties for validators include measures for not maintaining online presence and consensus participation, or acting against the network's best interests. These policies are designed to enforce reliability and trust within the network, safeguarding against actions that could undermine the collective security and efficiency of SUI.

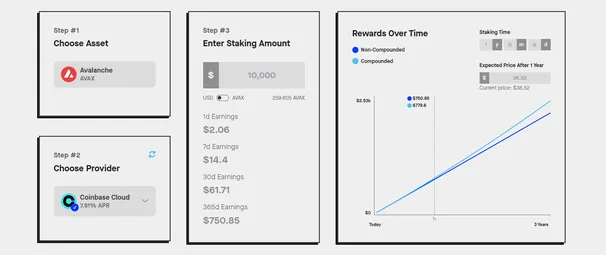

Avalanche* Staking

Avalanche's unique consensus mechanism ensures high throughput, low latency, and robust security, making it a leading platform for staking. Staking on Avalanche is facilitated through its three core blockchains: X-Chain, C-Chain, and P-Chain, each tailored to specific functionalities within the ecosystem. Validators, by staking AVAX, play a pivotal role in securing the network and consensus achievement. With incentives such as earning up to 7.65% APY and the platform's low hardware requirements, Avalanche encourages validators to uphold high performance and reliability. Moreover, Avalanche simplifies participation for token holders by enabling stake delegation to validators, thus democratizing the earning of rewards without the necessity to operate a validator node.

Avalanche incentivizes validators and delegators with competitive staking rewards, derived from network issuance of validator rewards. The rewards system, designed to mirror the validator's uptime and the staked AVAX volume, fosters a commitment to network security. Notably, Avalanche's distinctive approach includes a no slashing policy for validator misbehaviors, ensuring staked tokens are not at risk. This policy, coupled with the potential to earn up to 7.65% APY, makes staking on Avalanche particularly appealing, as it balances robust security measures with attractive economic incentives for both validators and delegators.

Contrary to many Proof-of-Stake networks that employ slashing as a deterrent against validator misbehavior, Avalanche opts for a no slashing mechanism. This decision stems from Avalanche's innovative consensus design, which prioritizes economic incentives over punitive measures to maintain validator integrity and network security. The absence of slashing reduces the risk for stakers, promoting a more inclusive and secure environment for network participants.

Why People Stake

Individuals choose to stake for several reasons: to contribute to the security and efficiency of their preferred blockchain, to participate in network governance, and to earn rewards on their holdings, which can often exceed traditional investment returns. The decision to stake also involves considerations of liquidity, network reliability, the ease of participation (UX), and the robustness of the validator community, among other factors.

By understanding the staking landscape across these leading PoS networks, participants can make informed decisions that align with their investment goals, risk tolerance, and interest in supporting blockchain technology's evolution.

Network Governance Through Staking

Staking in Proof of Stake networks extends beyond securing the network and earning rewards; it's also intrinsically linked to governance. Token holders who stake often receive voting rights, allowing them to influence the direction and policies of the blockchain. This section delves into how staking empowers participants to shape the future of their chosen networks.

Solana Governance

Solana’s governance model empowers SOL stakers by giving them a representative in crucial network decisions through an on-chain governance process. Validators vote on proposals on behalf of their delegators, with the weight of votes tied to the amount of SOL staked. This system ensures that governance decisions reflect the preferences of the broader community, reinforcing Solana’s democratic ethos. Participation in governance by actively managing your chosen validator is an integral aspect of staking on Solana, allowing token holders to shape the future direction of the network.

Ethereum Governance

With the migration to Ethereum 2.0 and its PoS consensus mechanism, staking has ascended to become a pivotal element of the network's governance framework. Validators, by virtue of securing the network, inherently engage in governance through their involvement in Ethereum Improvement Proposals (EIPs). This participatory governance model empowers the community, facilitating a democratic approach to the evolution of the network. It underscores Ethereum's commitment to a decentralized and community-driven future, where stakeholders have a voice in shaping the protocol's direction.

Cosmos Governance

Governance within the Cosmos network is deeply participatory, enabling stakers to exercise their right to vote on key proposals that influence the network's direction, including software upgrades and governance parameter adjustments. The innovative Inter-Blockchain Communication (IBC) protocol also expands governance capabilities to interconnected blockchains within the ecosystem, promoting a unified and decentralized governance structure. This empowers the Cosmos community to steer the development and policies of the network, reflecting a truly democratic governance model.

SUI Governance

As a newer entrant, SUI is positioning itself to leverage staking for robust network governance. Stakers are expected to play a significant role in shaping the network's evolution, with mechanisms in place to ensure broad participation and representation in governance decisions. SUI leverages staking mechanisms to underpin its governance model, ensuring that stakers have a significant voice in the network's future direction. The governance framework is designed to facilitate broad participation, allowing stakeholders to propose, debate, and vote on key decisions that shape the network. This inclusive approach aims to harness the collective intelligence of the SUI community, fostering a transparent and democratic process that guides the network's evolution.

Avalanche Governance

In the Avalanche ecosystem, stakers are entrusted with voting powers on crucial network decisions, ranging from updates to strategic community initiatives. Additionally, Avalanche introduces subnets, offering bespoke governance frameworks that allow for nuanced control and customization. This governance model empowers the community, ensuring that Avalanche remains adaptive and aligned with its stakeholders' interests.

The Impact of Staking on Governance

Effective governance mechanisms ensure that networks remain adaptable, secure, and aligned with their community's interests. For stakers, participating in governance is not only a right but a responsibility, as their decisions directly impact the network's future.

Evaluating Staking Options

The decision to stake your digital assets involves more than just picking a blockchain network; it also requires choosing the right platforms and tools to facilitate your staking journey. This section offers guidance on evaluating staking platforms and tools, ensuring you make informed choices that align with your staking goals.

Security and Reputation

The foremost consideration should be the platform's security measures and its reputation within the community. Look for platforms with a strong track record, transparent security practices, and positive feedback from current users.

User Experience

A platform's user interface and experience are critical, especially for those new to staking. Ease of use, clear instructions, and accessible support can significantly impact your staking experience.

Supported Networks and Assets

Depending on your investment strategy, you may prefer platforms that support multiple networks and a wide range of staking assets. This flexibility allows you to diversify your staking portfolio within a single platform.

Fees and Payout Structures

Understand the fee structure and payout frequency of the platform. Lower fees mean higher net rewards, but payout structures can also affect your earnings. Some platforms offer daily rewards, while others may have a different schedule.

Additional Features

Some platforms offer extra features such as auto-compounding, where your staking rewards are automatically restaked, or integrated governance participation, allowing you to vote directly from the platform.

Community and Educational Resources

Platforms that foster a strong community and provide educational resources can be invaluable, especially for those looking to deepen their understanding of staking strategies and blockchain technology.

Examples of Staking Platforms and Tools

Many users stake directly through their cryptocurrency wallets or custodial services, which can offer built-in staking functionalities for one or more networks.

Joining a staking pool can be a good option for individuals who don't meet the minimum staking requirements or prefer to spread their risk across multiple validators.

For those interested in liquid staking, DeFi platforms offer various protocols that allow you to stake your assets and receive yield in return.

Making an Informed Choice

The landscape of staking platforms and tools is ever-evolving, with new options emerging as the blockchain space grows. Staying informed, conducting thorough research, and considering your own staking preferences and risk tolerance are key to selecting the best platform for your needs.

Staking User Experience

For newcomers to the crypto space, the user experience (UX) and accessibility of staking platforms can significantly influence their participation and success in staking activities. This section explores how Solana, Ethereum, Cosmos, SUI, and Avalanche cater to users, particularly focusing on the interface design, educational support, and overall ease of use.

Solana Staking User Experience

Solana prioritizes a seamless staking experience with user-friendly tools and comprehensive guides to support new and existing participants. Wallets like SolFlare, Phantom, and Backpack enhance accessibility to staking, enabling users to delegate tokens efficiently. The community-driven platforms such as SolanaBeach.io.io)* and Validators.app offer detailed insights into validators' performance, assisting stakers in making informed decisions. These resources, coupled with active community forums and educational content, ensure a supportive environment for managing stakes and contributing to Solana’s security and performance. Additionally, Solana's ecosystem is known for its user-friendly interfaces and a wide array of applications, making it accessible for both new and experienced users.

Ethereum Staking User Experience

The user experience for staking on Ethereum has evolved to cater to a wide spectrum of participants. From solo home staking for enthusiasts seeking full control and maximized rewards, to staking as a service for those preferring a hands-off approach while still reaping rewards. Pooled staking and liquid staking options have democratized access to staking, enabling participation with any amount of ETH. These varied staking methods underscore Ethereum's adaptability, offering tailored solutions that align with users' preferences, risk appetites, and technical expertise. Despite Ethereum’s decentralized ideals, complexities related to gas fees and network congestion have historically made the user experience challenging, though it's continually improving as Ethereum embraces modularity.

Cosmos Staking User Experience

Cosmos prioritizes a user-friendly staking experience, streamlining the delegation process with intuitive interfaces. The network's commitment to interoperability and collaborative governance encourages user participation across its extensive ecosystem, however the learning curve for understanding the interoperability features and participating in multiple interconnected blockchains may require some adjustment for new users. Supported by a thriving community and rich educational resources, such as Cosmos Academy, Cosmos offers a nurturing environment for newcomers to staking. This approachable design and supportive community infrastructure make it easier for users to engage with and contribute to the Cosmos network.

SUI Staking User Experience

SUI prioritizes an intuitive and engaging staking experience, supported by comprehensive documentation. Efforts to educate users on these unique features, alongside active community engagement and support, underscore SUI's dedication to building a welcoming and inclusive ecosystem.

Avalanche Staking User Experience

Avalanche's staking experience is designed for accessibility and performance, featuring a user-centric interface complemented by comprehensive guides and community-driven support. Through the Core extension, users can effortlessly delegate AVAX, maintaining full control over their tokens without the need for third-party custody. Additionally, Avalanche provides a streamlined experience for users with fast transactions and low fees.

Enhancing Accessibility Through Design and Support

Across these networks, the focus on improving the user interface, providing comprehensive educational materials, and fostering supportive communities plays a critical role in lowering the barriers to entry for new stakers. By prioritizing user experience and accessibility, these blockchains not only facilitate participation in staking but also empower users to contribute to network security and governance confidently.

Harnessing Blockchain Communities

A supportive community, along with robust educational resources, is indispensable assets in encouraging staking participation. These elements not only foster a sense of belonging but also provide crucial support and guidance for stakers at all levels. Here's how community and support structures play a pivotal role across different blockchain networks:

Solana Community*

The Solana community plays a significant role in the ecosystem’s vibrancy and growth, offering extensive support and resources for stakers. From detailed documentation provided by the Solana Foundation to lively discussions on forums and Discord channels, the community is a hub of knowledge and collaboration. Educational initiatives and tools developed by and for the community ensure that both validators and delegators are well-informed, promoting effective participation in staking and governance. This engaged community is fundamental to Solana's mission of building a scalable, secure, and decentralized blockchain platform.

Ethereum Community

Ethereum's robust community ecosystem plays a vital role in supporting and educating participants about staking. EthStaker, a community dedicated to Ethereum staking, stands out as a useful tool for enthusiasts looking to dive into staking. It offers an array of resources, support, and forums for discussion, catering to both newcomers and experienced stakers. This vibrant community fosters a culture of knowledge-sharing and collaboration, ensuring that participants are well-equipped to navigate the complexities of staking and maximize their contributions to Ethereum's security and decentralization.

Cosmos Community

The Cosmos network's dedication to interoperability and decentralized governance is reflected in its vibrant community engagement. Cosmos and various project-specific channels offer stakers extensive support, information, and opportunities for involvement. Educational initiatives like Cosmos Academy and active forums like Cosmos Forum facilitate knowledge sharing and community interaction. These platforms play a crucial role in fostering a collaborative and informed staking community within the Cosmos ecosystem..

SUI Community

SUI's community-building efforts emphasize transparency, accessibility, and active engagement. By fostering open communication and providing resources for community members to contribute, SUI aims to cultivate a vibrant ecosystem that supports its development and growth.

Avalanche Community

The Avalanche community is at the heart of its rapidly expanding ecosystem, characterized by a developer-friendly approach and a dynamic environment. Through active engagement on social media, educational webinars, and hackathons, Avalanche fosters innovation and collaboration among its members. Supported by a wealth of official documentation and tutorials, the community is well-equipped to contribute to Avalanche's vision of a decentralized and scalable blockchain network.

The Value of Community Engagement

Engaging with a blockchain's community can significantly enhance the staking experience. It allows users to stay updated on network developments, gain insights into best practices for staking, and access support from both the community and official channels. Furthermore, active participation in governance and decision-making processes strengthens the network's decentralization and aligns with the ethos of blockchain technology.

Liquid Staking Options

As blockchain ecosystems evolve, the concept of liquid staking has emerged as a transformative solution, addressing one of the primary limitations of traditional staking: liquidity. Liquid staking allows participants to contribute to network security and consensus while maintaining access to their assets' liquidity. This is achieved through the issuance of derivative tokens that represent the staked assets, enabling users to engage in other DeFi activities without unstaking their primary assets.

How Liquid Staking Works

When users stake their tokens through a liquid staking protocol, they receive derivative tokens in return. These tokens can be used across a variety of DeFi platforms for lending, borrowing, or trading, thus unlocking the liquidity of staked assets. This mechanism not only enhances the capital efficiency within the ecosystem but also broadens the utility and appeal of staking.

Impact on the DeFi Ecosystem

Liquid staking integrates closely with the broader DeFi ecosystem, creating synergies that enhance both staking and DeFi platforms. By providing liquidity to staked assets, liquid staking enables more capital to flow into DeFi protocols, potentially leading to more innovation and stability in the market. Furthermore, it offers stakers the opportunity to compound their returns by utilizing their derivative tokens in yield-generating DeFi activities.

Considerations and Risks

While liquid staking presents numerous benefits, participants should be aware of the risks, including smart contract vulnerabilities and the potential for liquidity mismatches during market volatility. The valuation of derivative tokens can also fluctuate based on the underlying staked assets and market conditions, introducing an additional layer of complexity and risk.

Solana Staking Experience

Solana offers a staking experience that stands out in the Proof of Stake (PoS) ecosystem, characterized by the ease of participation and the vibrant community it fosters. Staking on Solana offers a combination of accessibility, technological advancement, and community engagement that enhances the staking journey for all participants.

Accessibility and Participation Made Easy

Many product builders in Solana's ecosystem have intentionally prioritized ease of access and user friendliness in their dapps. This approach lowers the barrier to entry, inviting a diverse group of users to engage with staking, from seasoned investors to those new to the crypto space. This focus on accessibility is a testament to Solana's commitment to inclusivity and widespread participation.

A Vibrant Validator Ecosystem

Solana is well known for its lively and engaged validator community. Validators on Solana are known for their active participation beyond just maintaining network uptime. They are involved in community initiatives, development projects, and often play a pivotal role in network governance. This engagement enriches the staking experience, providing stakers with a wide range of choices for validators who are not only reliable but also contribute positively to the Solana ecosystem.

Innovative Approach to Rewards and Network Health

Solana’s staking rewards system is thoughtfully designed to ensure a healthy balance between attractive returns for stakers and the long-term stability of the network. By implementing a dynamic inflation schedule and transparent reward distribution mechanisms, Solana encourages sustained participation, contributing to the overall security and robustness of the network.

A Thriving Community and Ecosystem

Various members of the Solana community offer extensive resources, support, and platforms to make engaging with Solana staking easy. From detailed guides and tutorials to active discussion forums, the community serves as a backbone for stakers, enabling a shared space for learning, collaboration, and innovation.

As Solana continues to evolve, its approach to staking remains a key differentiator, offering a blend of technological innovation, community engagement, and user-centric design. This unique combination positions Solana as not just a platform for staking but a vibrant ecosystem where participation is rewarding and impactful, driving forward the vision of a decentralized and efficient blockchain.

Future of Blockchain Staking

The landscape of blockchain staking is poised for significant evolution, driven by technological innovations, regulatory changes, and shifts in the crypto market. As we look to the future, several key trends are expected to shape the staking ecosystem:

Technological Advancements

The continuous quest for scalability, security, and efficiency in blockchain networks is likely to introduce new staking models and mechanisms. Layer 2 solutions and sharding are examples of technologies that could further enhance the performance of PoS networks and, by extension, the staking experience for participants.

Regulatory Environment

As blockchain technology gains mainstream acceptance, regulatory scrutiny is expected to increase. The regulatory landscape will play a crucial role in shaping staking rewards, the operational practices of staking pools, and the overall participation of institutional and retail investors in the staking ecosystem.

Decentralization Efforts

A growing emphasis on decentralization within PoS networks is anticipated, with novel approaches to validator selection and reward distribution. These efforts aim to prevent the centralization of control and ensure a more equitable and secure network.

Cross-Chain Staking

The development of cross-chain technologies and interoperability protocols is likely to facilitate staking across different blockchains. This could enable stakers to participate in multiple networks simultaneously, diversifying their staking activities and potentially maximizing returns.

Environmental Considerations

The environmental impact of blockchain operations continues to be a critical concern. PoS networks, known for their energy efficiency compared to PoW networks, are expected to adopt further green initiatives and practices, making staking an appealing option for eco-conscious participants.

Growth of DeFi and Liquid Staking

The integration of liquid staking with DeFi is poised to deepen, with liquid staking playing a pivotal role in unlocking liquidity and enabling stakers to maximize their capital efficiency. As the DeFi sector expands, the demand for liquid staking solutions is likely to surge, enhancing the utility and value of staked assets.

Security Innovations

Security remains a paramount concern in the staking ecosystem. Advances in cryptographic techniques, smart contract audits, and validator node security will be crucial in mitigating risks associated with staking, slashing, and overall network integrity.

Navigating the Future

For participants in the staking ecosystem, staying informed about these trends and developments is essential for making strategic decisions. Whether it's adapting to new staking models, navigating regulatory changes, or exploring cross-chain staking opportunities, the future of staking offers both challenges and opportunities. As the blockchain space continues to mature, the evolution of staking mechanisms will undoubtedly play a central role in the growth and sustainability of PoS networks.

Risks When Staking Crypto

While staking presents an attractive opportunity for earning rewards and participating in blockchain governance, it's not without its risks and considerations. Prospective stakers should be aware of several factors that can impact their staking experience and potential returns:

Market Volatility

The value of staked assets can fluctuate significantly due to crypto market volatility. Stakers are exposed to the risk of asset depreciation, which could offset the rewards earned through staking.

Slashing Risks

In networks that implement slashing, validators risk losing a portion of their staked assets due to network violations, such as double signing or prolonged downtime. This emphasizes the importance of operational security and diligence.

Liquidity Concerns

Traditional staking locks up assets for a period, reducing liquidity and access to capital. While liquid staking offers a solution, it introduces additional layers, such as the risk associated with derivative tokens and the platforms that issue them.

Validator Performance and Selection

Choosing a reliable and high-performing validator is crucial for maximizing staking rewards. Poor validator performance or misconduct can lead to missed rewards or even slashing penalties for delegators.

Regulatory and Tax Implications

The regulatory landscape for crypto assets and staking rewards continues to evolve. Stakers must navigate tax obligations and potential regulatory changes that could affect their staking activities.

Smart Contract and Security Risks

Depending on the blockchain, staking can involve interacting with smart contracts, which can contain vulnerabilities. Additionally, the security of staking platforms and wallets is paramount to prevent asset theft.

Network-Specific Risks

Each blockchain network may have unique risks based on its consensus mechanism, governance model, and technological infrastructure. Stakers should conduct thorough research to understand these nuances.

Mitigating Risks

To mitigate these risks, stakers can take several steps, including diversifying their staking investments across different networks, conducting due diligence on validators, utilizing reputable staking platforms, and staying informed about regulatory and market developments. Additionally, engaging with the community and leveraging educational resources can enhance stakers' decision-making processes and operational security.

Conclusion

As we've navigated the complexities and nuances of staking across various PoS networks, it's clear that the landscape offers a rich tapestry of opportunities for those willing to engage with blockchain technology on a deeper level. From the high-speed transactions of Solana to the groundbreaking governance models of Cosmos, each network presents a unique set of features designed to cater to the needs and aspirations of its community. For newcomers and seasoned crypto enthusiasts alike, staking is not just a means to earn rewards but a gateway to participating in the governance and security of the digital future. Armed with the knowledge of user-friendly practices, liquidity solutions, and the critical role of community support, individuals are better equipped to make informed decisions that align with their goals. Whether you're drawn to the robust ecosystem of Ethereum, the innovative staking mechanisms of SUI, or the decentralized finance (DeFi) possibilities unlocked by Avalanche, the world of staking is ripe with potential for exploration and growth. As the blockchain landscape continues to evolve, staying informed and adaptable will be key to navigating the future of staking, governance, and beyond.